In a world gone fully online—including a large majority of the workforce—information is consistently flowing through us. At the push of a button, we can connect with some of the most lucrative information available on the planet.

Whether it be online shopping, using our phones to book vacations, or a tablet to watch our exterior security videos, we are all connected. As beneficial as this connectivity can be, it also comes with downsides—online scams.

Here are the top ways to protect yourself from online scams:

Types of Online Scams

Many types of online scams exist—and it is getting worse each year. The most common types of online scams include but are not limited to:

- Phishing scams – a tricky way to use emails and lead you to a fraudulent website

- Online shopping scams – ads designed to appear as a legitimate shopping website to obtain your credit card information

- Lottery/sweepstakes scams – bogus letters and emails stating “You’re A Winner!” to obtain your personal information

- Text message scams – scammers use text messages to get you to click a link and obtain your personal information

- Bitcoin scams – threatening letters that suggest releasing private content unless a Bitcoin fee is paid

- Imposter scams – entities such as IRS stating that you owe money or risk severe consequences

- And many more

These scams are designed to acquire your most private and personal information. This includes your name, age, phone number, address, place of employment, credit card information, social security number, and more.

How to Protect Yourself From Online Scammers

Scammers are never going to stop. However, you can throw a wrench in their plans by properly protecting yourself from online scammers.

Here are the top ways to protect yourself from scamming:

Do not give out your information

You may receive an email or text message from a supposedly popular and well-known business or entity. No matter what the email or text reads, you must not disclose any personal information.

No matter how genuine the message reads, do not trust it. Even if they say your personal data has been compromised, this is all part of the rouse. Businesses do not email or text asking for private information for any reason, ever.

Keep your information safe and secure

The most important element of self-protection from online scams is to keep your information secure. Now, this is not always foolproof as new ways of scamming are always evolving; however, you can do your best to keep protecting your information and identity online.

You can secure your information by:

- Using a secure password manager

- Buying a physical two-factor authentication device

- Using passcodes on both your phones, tablets, and computer

- Not using public Wi-Fi to access personal accounts and information

Screen phone calls

Cell phone carriers are now making it more accessible to screen incoming phone calls. This is why “potential spam” may be showing up on your phone now more than ever.

To combat identity theft and online scams, phone companies are allowing users extra protection. T-Mobile and AT&T both offer scam protection services along with several other phone carriers.

Check your credit report often

Your online credit report holds key information about your financial life and standing. By checking your credit report often, you can immediately spot if someone has opened a loan or credit card in your name.

Staying on top of your credit report is the best way to prevent money from going missing from your bank accounts. If you see something suspicious, immediately contact the credit report bureau to file a discrepancy with your account.

Bottom Line

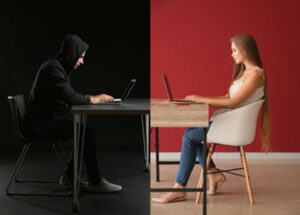

Scams are out there—and they are not going away any time soon. Scammers are getting more sneaky and efficient where it may be difficult to spot who is genuine and who is trying to steal from you.

By keeping your information secure, not revealing any personal information online, screening your phone calls, and keeping an eye on your credit report and standing, you can protect yourself and your finances.

Recent Comments